Traditional Ira Salary Limits 2025. Unlike an ira, you can get help building your 401(k) savings. Another situation where a conversion might be worthwhile is if your income is too high to contribute to a roth ira directly.

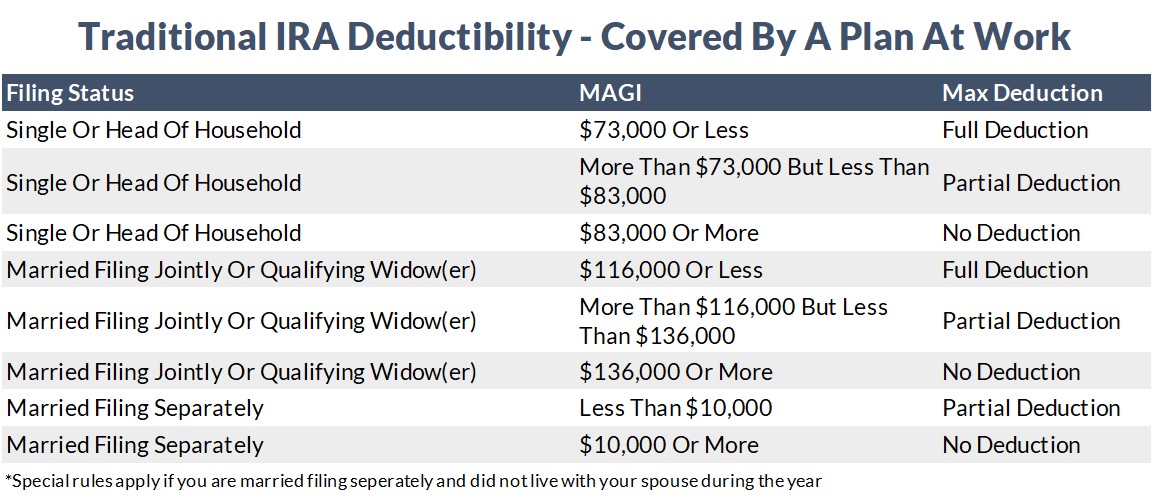

You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to. For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined.

Traditional Ira Tax Deduction Limits 2025 Eryn Odilia, If you earn $90,000 per year,. The maximum total annual contribution for all your iras (traditional and roth) combined is:

Tax Rules 2025 Retha Martguerita, Those aged 50 and older can contribute an additional $1,000 as a. Unlike an ira, you can get help building your 401(k) savings.

Hud Home Limits 2025 Audre Doralynne, In 2025, you can contribute up to $7,000 to an ira or, if you're age 50 or older, up to $8,000. Here's what you need to know about traditional ira income limits in 2025 and 2025.

2025 Roth Ira Limits Trude Hortense, For 2025, the total contributions you make each year to all of your. Whether you’re contributing to a traditional ira, roth ira, or a combination, the 2025.

IRA Contribution Limits in 2025 Meld Financial, If you are 50 and older, you can contribute an additional. This figure is up from the 2025 limit of $6,500.

2025 Ira Limits Over 50 Cori Joeann, If you earn $90,000 per year,. Here are the 2025 ira contribution limits.

IRS Unveils Increased 2025 IRA Contribution Limits, Here are the 2025 ira contribution limits. Enjoy higher contribution limits in 2025.

2025 Roth Ira Limits Trude Hortense, You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to. There are traditional ira contribution limits to how much you can put in.

IRA Contribution Limits And Limits For 2025 And 2025 Forex, You can contribute to a traditional ira regardless of your salary. Ira deduction limits | internal revenue service.

traditional ira limits Choosing Your Gold IRA, You can contribute to a traditional ira regardless of your salary. Simple ira contribution limits for 2025, the employee contribution limits for a simple ira are $16,000.