Irs 401k 2025 Limit. Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up to $23,000 in 2025, a $500 increase. The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

For example, say you are offered a $50,000 salary, and the employer offers to match 50% of your contributions for up to 3% of your salary. This limit includes all elective employee salary deferrals and any contributions made to a designated roth.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, The basic employee contribution limit for 2025 is $23,000 ($22,500 for 2025). Since 401 (k) plans offer higher contribution limits than iras do, you may have been told that they're your.

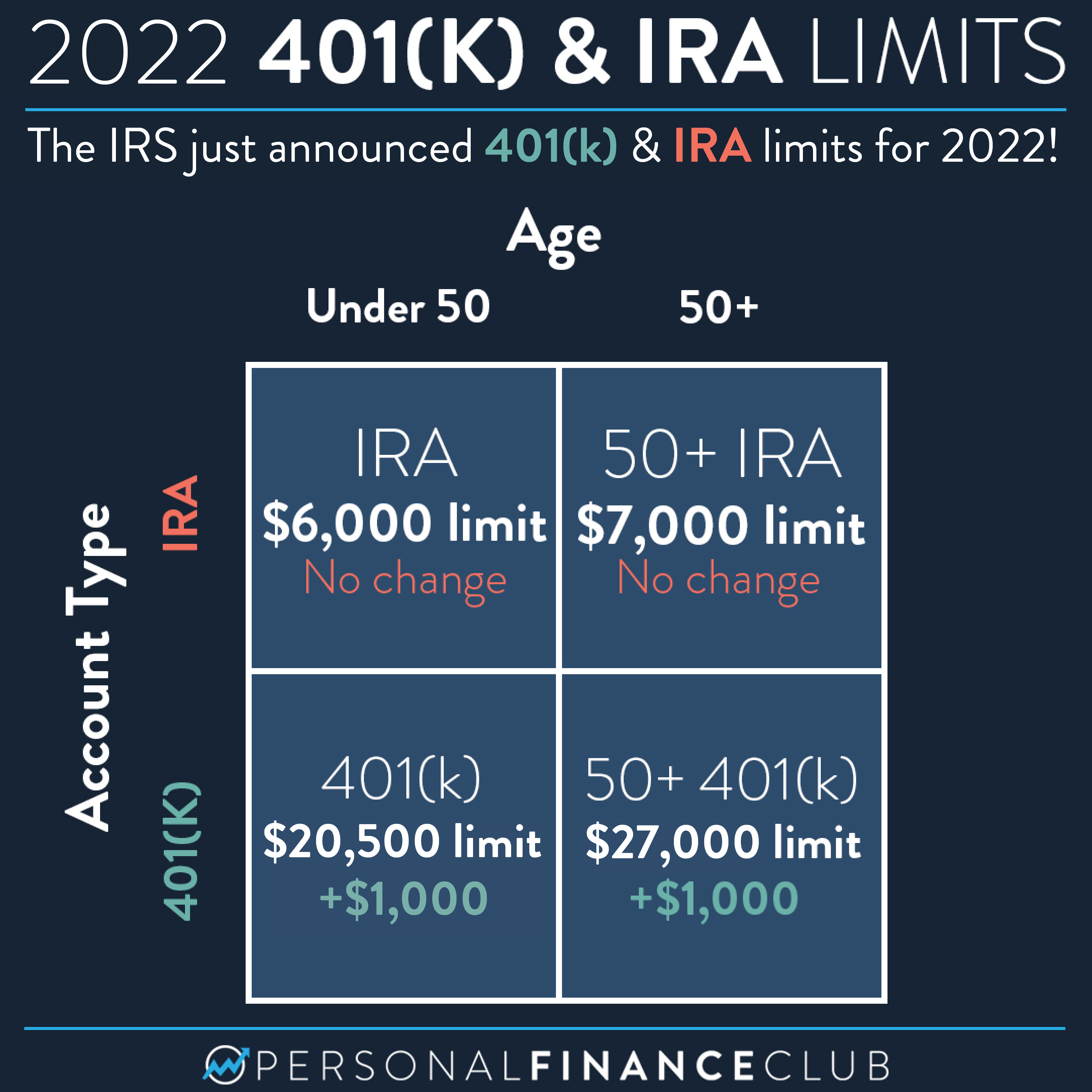

The IRS just announced the 2025 401(k) and IRA contribution limits, 2025 health savings account (hsa) contribution. If you’re one of those who has prioritized retirement by opening a roth 401 (k), it’s.

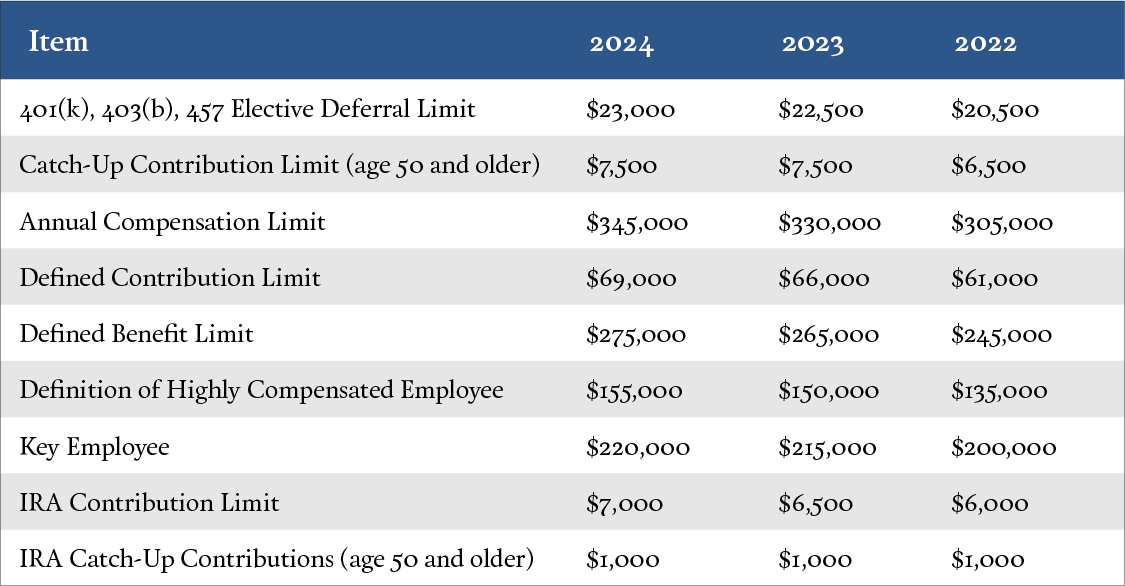

Irs Limit 2025 Winny Kariotta, The annual compensation limit (applicable to many retirement plans) is increased to $345,000, up from $330,000. The contribution limit will increase from $22,500 in 2025 to $23,000.

What Is The Ira Contribution Limit For 2025 a2022c, Since 401 (k) plans offer higher contribution limits than iras do, you may have been told that they're your. The 2025 401 (k) contribution limit.

Significant HSA Contribution Limit Increase for 2025, However, you and your employer. The contribution limit will increase from $22,500 in 2025 to $23,000.

401(k) Contribution Limits in 2025 Meld Financial, A 401 (k) is the best place for your retirement savings. For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025.

New IRS Indexed Limits for 2025 Aegis Retirement Aegis Retirement, The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions. 401k 2025 contribution limit chart, total possible 401 (k) contribution = $30,000.

2025 IRS 401k CatchUp Contributions What's the Limit?, For 2025, this limitation is increased to $53,000, up from $50,000. For example, say you are offered a $50,000 salary, and the employer offers to match 50% of your contributions for up to 3% of your salary.

self directed 401k contribution limits 2025 Choosing Your Gold IRA, Heads of households will see a $21,900 standard deduction — a $1,100 increase from the 2025 tax year. If you're age 50 or.

How The SECURE Act Changes Your Retirement Planning The Ugly Budget, For every $1 you contribute. 401k 2025 contribution limit chart, this limit is an increase from the.

For example, say you are offered a $50,000 salary, and the employer offers to match 50% of your contributions for up to 3% of your salary.